Last Updated on July 27, 2023

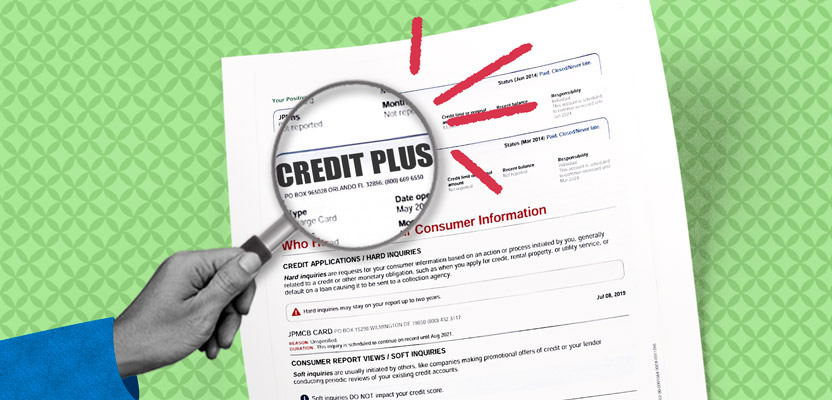

Welcome to the world of credit reports, where every financial move you make is meticulously recorded and analyzed. It can be quite perplexing to see unfamiliar names and entities pop up on your credit report, such as Credit Plus. Who is Credit Plus and why are they appearing on your credit report? In this article, we will delve into the intricacies of Credit Plus, understanding its purpose and how it operates. We will also explore the various types of information Credit Plus provides and how it can impact your credit score. Additionally, we will discuss the steps you can take to dispute any inaccurate information from Credit Plus and what to do if you have never heard of them before. So, let’s dive in and take control of your credit report while unraveling the role of Credit Plus.

What is Credit Plus and how does it work?

Credit Plus is a company that provides information to credit reporting agencies, which in turn affects your credit report. Here are some key points to understand about Credit Plus:

- Credit Plus is not a credit reporting agency itself, but rather a provider of information to these agencies.

- They collect data from various sources, such as lenders, landlords, and public records, to create a comprehensive profile of your credit history.

- This information is then shared with credit reporting agencies, who use it to calculate your credit score and generate your credit report.

- Credit Plus may appear on your credit report as an inquiry or as a provider of specific information, such as a collection or a late payment.

- The presence of Credit Plus on your credit report does not necessarily mean that you have a direct relationship with them. It simply means that they have provided information about you to the credit reporting agencies.

Understanding how Credit Plus works is important in order to fully comprehend the information on your credit report and take appropriate action if needed.

Why is Credit Plus appearing on your credit report?

Credit Plus may appear on your credit report for a variety of reasons. One possible reason is that you have applied for credit or a loan with a lender that uses Credit Plus as part of their credit evaluation process. In this case, Credit Plus would have accessed your credit information to provide the lender with additional data and insights to help them make a decision.

Another reason Credit Plus may appear on your credit report is if you have signed up for a credit monitoring service that includes Credit Plus as one of its features. These services often pull data from multiple credit bureaus and provide you with a comprehensive view of your credit history.

It’s also possible that Credit Plus is appearing on your credit report due to an error or identity theft. In these cases, it’s important to review your credit report carefully and take steps to dispute any inaccurate information. Monitoring your credit report regularly can help you catch and address any issues promptly.

Overall, the presence of Credit Plus on your credit report is not necessarily a cause for concern. It’s important to understand why it is there and to take appropriate action if needed.

Understanding the different types of information Credit Plus provides

When you see Credit Plus on your credit report, it’s important to understand the different types of information they provide. Credit Plus is a company that specializes in credit reporting and provides various types of data to lenders and financial institutions.

One type of information that Credit Plus provides is your credit history. This includes details about your past and current credit accounts, such as credit cards, loans, and mortgages. It also includes information about your payment history, including any late payments or defaults.

Another type of information provided by Credit Plus is your credit inquiries. This refers to the number of times your credit report has been accessed by lenders or other authorized parties. It’s important to note that too many inquiries within a short period of time can negatively impact your credit score.

Credit Plus also provides information about public records, such as bankruptcies, tax liens, and judgments. These records can have a significant impact on your creditworthiness and may affect your ability to obtain credit in the future.

By understanding the different types of information Credit Plus provides, you can better assess the impact it may have on your credit report and take appropriate steps to manage your credit effectively.

Understanding the different types of information Credit Plus provides

When Credit Plus appears on your credit report, it is important to understand the different types of information it provides. Here are some key points to consider:

- Credit Inquiries: Credit Plus may include a list of companies that have requested your credit report. These inquiries can be classified as either hard inquiries or soft inquiries. Hard inquiries are made when you apply for credit, such as a loan or credit card. Soft inquiries, on the other hand, are made when you check your own credit or when a company checks your credit for promotional purposes.

- Account Information: Credit Plus may also provide details about your credit accounts, such as credit cards, loans, and mortgages. This information includes the account balance, payment history, and any late payments or defaults.

- Public Records: If you have any bankruptcies, tax liens, or judgments, Credit Plus may include this information on your credit report. These negative public records can have a significant impact on your credit score.

- Collection Accounts: If you have any accounts that have been sent to collections, Credit Plus may list these accounts on your credit report. Collection accounts can have a negative impact on your credit score and should be addressed as soon as possible.

By understanding the different types of information Credit Plus provides, you can better assess the impact it may have on your credit score and take appropriate actions to improve your credit standing.

6. How to dispute inaccurate information from Credit Plus

If you find inaccurate information on your credit report from Credit Plus, it is important to take action to correct it. Here are the steps you can take to dispute the inaccurate information:

- Review your credit report: Carefully go through your credit report and identify the inaccurate information provided by Credit Plus.

- Gather supporting documents: Collect any documents or evidence that can prove the inaccuracies in the information provided by Credit Plus.

- Write a dispute letter: Compose a formal letter to the credit reporting agency that includes your personal information, a clear explanation of the inaccuracies, and any supporting documents you have gathered.

- Send the dispute letter: Mail the dispute letter to the credit reporting agency via certified mail with a return receipt requested. This will provide proof that you have sent the letter.

- Follow up: Keep track of the progress of your dispute and follow up with the credit reporting agency if necessary. They are required to investigate your dispute within 30 days.

- Monitor your credit report: After disputing the inaccurate information, continue to monitor your credit report to ensure that the corrections have been made.

Remember, it is your right to have accurate information on your credit report. By following these steps, you can take control of your credit report and ensure that it reflects your true financial history.

Steps to take if you have never heard of Credit Plus

If you have never heard of Credit Plus and it is appearing on your credit report, there are several steps you can take to address the situation. First, it is important to gather all the information you have about Credit Plus. Look for any correspondence or documentation that may provide clues about why it is on your credit report.

Next, contact Credit Plus directly to inquire about the information they have on file for you. It is possible that there has been a mistake or misunderstanding, and they may be able to provide clarification or resolve the issue.

If you are unable to reach a resolution with Credit Plus, you can file a dispute with the credit reporting agencies. This will initiate an investigation into the accuracy of the information being reported. Be sure to provide any supporting documentation or evidence that may help support your case.

Finally, it is important to continue monitoring your credit report regularly to ensure that any inaccuracies or unfamiliar information are promptly addressed. By staying vigilant and taking proactive steps, you can maintain control over your credit report and ensure its accuracy.

The importance of monitoring your credit report regularly

One crucial aspect of maintaining a healthy credit profile is regularly monitoring your credit report. This involves reviewing the information provided by Credit Plus and other credit reporting agencies to ensure its accuracy and identify any potential issues.

Monitoring your credit report regularly is essential for several reasons. Firstly, it allows you to detect any errors or inaccuracies in the information provided by Credit Plus. Mistakes on your credit report can negatively impact your credit score and may even result in the denial of credit applications. By identifying and disputing these errors promptly, you can protect your creditworthiness.

Additionally, monitoring your credit report can help you detect signs of identity theft or fraudulent activity. If you notice unfamiliar accounts or suspicious transactions, it could indicate that someone has gained unauthorized access to your personal information. Taking immediate action to address these issues can prevent further damage to your credit and financial well-being.

In conclusion, regularly monitoring your credit report is a proactive step towards maintaining a healthy credit profile. By staying vigilant and addressing any inaccuracies or fraudulent activity promptly, you can take control of your credit report and protect your financial future.

Other factors to consider when reviewing your credit report

When reviewing your credit report, it is important to consider other factors that may have an impact on your overall creditworthiness. While Credit Plus provides valuable information, it is not the only factor that lenders and creditors consider when making decisions about your creditworthiness.

Payment history: One of the most important factors that lenders consider is your payment history. This includes whether you have made your payments on time, if you have any late payments or delinquencies, and if you have any accounts in collections.

Credit utilization: Another important factor is your credit utilization, which is the amount of credit you are using compared to your total available credit. Lenders prefer to see a low credit utilization ratio, as it indicates that you are not relying too heavily on credit.

Length of credit history: The length of your credit history also plays a role in your creditworthiness. Lenders like to see a long credit history, as it provides them with more information about your borrowing and repayment habits.

Types of credit: The types of credit you have also matter. Lenders like to see a mix of different types of credit, such as credit cards, loans, and mortgages, as it demonstrates your ability to manage different types of credit responsibly.

While Credit Plus provides valuable information, it is important to consider these other factors when reviewing your credit report. By understanding the various factors that lenders consider, you can take steps to improve your creditworthiness and maintain a healthy credit profile.

Taking Control of Your Credit Report and Understanding the Role of Credit Plus

After exploring the various aspects of Credit Plus and its impact on your credit report, it is crucial to take control of your financial standing. Understanding the role of Credit Plus is the first step towards achieving this goal. By familiarizing yourself with the different types of information Credit Plus provides, you can gain valuable insights into your creditworthiness.

Monitoring your credit report regularly is another essential practice to adopt. This allows you to stay informed about any changes or inaccuracies that may arise, including those related to Credit Plus. By doing so, you can promptly address any discrepancies and maintain a healthy credit score.

Furthermore, it is important to consider other factors when reviewing your credit report. While Credit Plus plays a significant role, it is not the sole determinant of your creditworthiness. Factors such as payment history, credit utilization, and length of credit history also contribute to your overall credit score.

In conclusion, taking control of your credit report and understanding the role of Credit Plus is crucial for maintaining a healthy financial profile. By staying vigilant, monitoring your credit report regularly, and considering all relevant factors, you can ensure that your creditworthiness remains intact.

Learn about Credit Plus on your credit report, how it works, and how it can impact your credit score. Take control of your credit report today!

About The Author

Pat Rowse is a thinker. He loves delving into Twitter to find the latest scholarly debates and then analyzing them from every possible perspective. He's an introvert who really enjoys spending time alone reading about history and influential people. Pat also has a deep love of the internet and all things digital; she considers himself an amateur internet maven. When he's not buried in a book or online, he can be found hardcore analyzing anything and everything that comes his way.