Last Updated on July 27, 2023

Understanding the Importance of Filling Out a Check Correctly

Writing a check may seem like a simple task, but it is essential to do it correctly to avoid any complications. Whether you are paying bills or making a purchase, filling out a check accurately is crucial. In this article, we will guide you through the step-by-step process of filling out a check in cents. From writing the date to signing the check, we will cover all the necessary details. Additionally, we will provide you with tips to ensure accuracy and avoid common mistakes. By the end of this article, you will have mastered the art of filling out a check correctly.

Step 1: Write the Date on the Appropriate Line

- Start by writing the date on the top right corner of the check.

- Use the full date, including the month, day, and year.

- Write the date in a clear and legible manner.

Step 2: Write the Recipient’s Name on the “Pay to the Order of” Line

- On the line that says “Pay to the Order of,” write the name of the person or company you are paying.

- Make sure to spell the name correctly and use the full legal name if possible.

- If you are unsure of the correct spelling, double-check with the recipient or use a reliable source.

Step 2: Write the Recipient’s Name on the “Pay to the Order of” Line

Once you have written the date on the appropriate line, the next step in filling out a check is to write the recipient’s name on the “Pay to the Order of” line. This is where you specify who the check is being made out to. It is important to write the recipient’s name clearly and accurately to ensure that the check is processed correctly.

When writing the recipient’s name, be sure to include their full legal name. Avoid using nicknames or abbreviations, as this can cause confusion and may result in the check being rejected. If you are unsure of the correct spelling or full name of the recipient, it is always best to double-check before writing it on the check.

Remember, the recipient’s name should be written on the line that is labeled “Pay to the Order of” or a similar phrase. This line is typically located towards the top of the check, above the numerical amount box. Take your time and write the recipient’s name neatly and legibly to ensure that there are no issues when the check is processed.

Step 2: Write the Recipient’s Name on the “Pay to the Order of” Line

One of the crucial steps in filling out a check correctly is writing the recipient’s name on the “Pay to the Order of” line. This line is where you specify who the check is being made out to, and it is essential to do so accurately.

When writing the recipient’s name, it is important to use their full legal name. Avoid using nicknames or abbreviations, as this can lead to confusion and potential issues with the check being processed. If you are unsure of the correct spelling or full name of the recipient, it is always best to verify it before writing it on the check.

The “Pay to the Order of” line is typically located towards the top of the check, above the numerical amount box. Take your time and write the recipient’s name neatly and legibly to ensure that there are no errors or misunderstandings. By following this step accurately, you can ensure that the check reaches the intended recipient without any complications.

Step 3: Write the Amount in Numerical Form on the Box Provided

Now that you have written the recipient’s name on the “Pay to the Order of” line, it’s time to move on to the next step: writing the amount in numerical form on the box provided. This step is crucial as it ensures that the correct amount is deducted from your account.

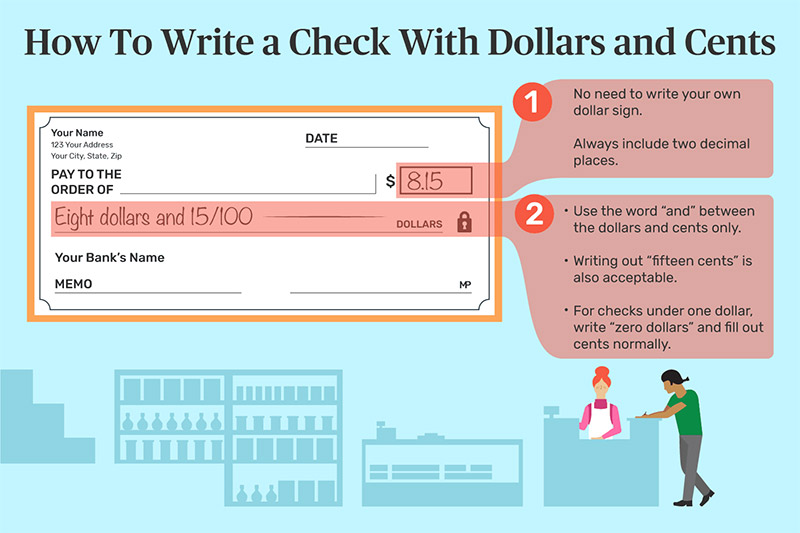

To do this, locate the box on the right-hand side of the check. It is usually labeled with a dollar sign ($) or the word “Amount.” Carefully write the amount using numbers only, without any symbols or punctuation marks. For example, if you are writing a check for fifty dollars and twenty-five cents, you would write “50.25” in the box.

Remember to be precise and double-check your work to avoid any errors. Even a small mistake in the numerical form can lead to significant discrepancies in your finances. Take your time and ensure that the amount is written clearly and accurately.

Once you have completed this step, you are ready to move on to the next step: writing the amount in words on the line below the recipient’s name.

Step 4: Write the Amount in Words on the Line Below the Recipient’s Name

Writing the amount in words is an important step in filling out a check correctly. This helps to prevent any confusion or errors when the check is being processed. Here are some tips to follow:

- Start by writing the dollar amount in words, using uppercase letters.

- Write the word “and” after the dollar amount, followed by the cents in words.

- If there are no cents, write the word “only” after the dollar amount.

- Use hyphens between the words for numbers from twenty-one to ninety-nine.

- Write the amount close to the left-hand side of the line to prevent any alterations.

For example, if the check amount is $52.75, you would write “Fifty-two and 75/100” or “Fifty-two dollars and 75 cents” on the line below the recipient’s name.

Remember to take your time and double-check your spelling and accuracy when writing the amount in words. Any mistakes could lead to confusion or delays in processing the check.

Step 5: Add the Memo Line (Optional)

Adding a memo line to your check can provide additional information about the purpose of the payment. While it is not mandatory, it can be helpful for both you and the recipient to have this information documented.

- Locate the memo line, which is usually located in the bottom left corner of the check.

- Write a brief description of the payment purpose on the memo line. For example, if you are paying for a birthday gift, you can write “Birthday gift” on the memo line.

- Keep the description concise and clear. Avoid using vague or ambiguous terms that may cause confusion.

- Remember that the memo line is not legally binding, so it does not affect the validity of the check.

- However, it can be useful for record-keeping purposes, especially if you need to track your expenses or reconcile your bank statements.

- If you are writing a check for a business transaction, it is recommended to include the invoice number or any other relevant reference number on the memo line.

By adding a memo line, you can provide additional context to your payment and ensure that both you and the recipient have a clear understanding of the purpose of the transaction.

Step 6: Sign the Check on the Signature Line

After you have filled out all the necessary information on the check, it is crucial to sign it on the designated signature line. Your signature serves as a verification that you authorize the payment and that the check is valid. It is important to sign your check using the same signature that you have on file with your bank.

When signing the check, make sure to use a pen with black or blue ink. Avoid using pencils or any other color ink, as they may not be accepted by the bank. Your signature should be legible and match the one on your identification documents.

Remember, your signature is a legal representation of your identity, so it is essential to sign your checks carefully and consistently. If your signature has changed or you are unsure about the validity of your signature, it is advisable to update it with your bank to avoid any potential issues with your checks being accepted or processed.

Step 7: Fill Out the Check Register (Optional)

While filling out the check register may be optional, it is highly recommended to keep track of your finances accurately. The check register is a small booklet that comes with your checkbook, and it serves as a record of all the checks you write.

To fill out the check register, start by writing the date of the transaction in the appropriate column. Then, write the name of the recipient or payee next to it. In the “Description” column, you can briefly note the purpose of the payment, such as “groceries” or “rent.”

Next, enter the amount of the check in the “Payment/Debit” column. If you receive any deposits or credits, you can record them in the “Deposit/Credit” column. Finally, calculate the new balance by adding or subtracting the amounts accordingly.

By keeping your check register up to date, you can easily track your expenses and ensure that you have enough funds in your account. It also helps in reconciling your bank statement and identifying any discrepancies. So, even though it may seem optional, filling out the check register is a smart financial habit to adopt.

Tips for Accuracy and Avoiding Common Mistakes

When it comes to filling out a check, accuracy is key. Making mistakes can lead to complications and delays in processing your payment. To ensure that you fill out your check correctly, here are some helpful tips:

1. Double-check the recipient’s name:

Before writing the recipient’s name on the “Pay to the Order of” line, make sure you have the correct spelling and details. Mistakenly writing the wrong name can result in the check being invalid.

2. Be precise with the numerical amount:

When writing the amount in numerical form, be sure to write it clearly and accurately. Avoid using abbreviations or symbols that may cause confusion. For example, instead of writing “1k,” write “1000.”

By following these tips, you can ensure that your check is filled out accurately and avoid common mistakes. Remember, taking the time to fill out your check correctly will save you from potential headaches and ensure that your payment is processed smoothly.

Mastering the Art of Filling Out a Check Correctly

After going through the step-by-step process of filling out a check correctly, you are now equipped with the knowledge to master this essential skill. By following these guidelines, you can ensure accuracy and avoid common mistakes that may lead to financial complications.

Remember, the date is the first thing you need to write on the appropriate line. This is crucial for record-keeping and tracking your expenses.

Next, write the recipient’s name on the “Pay to the Order of” line. Be careful to spell it correctly to avoid any confusion or issues with the transaction.

Then, write the amount in numerical form on the box provided. Double-check for any errors to prevent any discrepancies.

Additionally, write the amount in words on the line below the recipient’s name. This serves as a backup in case there is any confusion or dispute regarding the numerical amount.

Furthermore, consider adding a memo line if necessary. This can provide additional information about the purpose of the payment.

Lastly, sign the check on the signature line to validate the transaction. This is a crucial step to ensure the check is legally binding.

By following these steps and incorporating the tips for accuracy, you can confidently fill out a check correctly and avoid any potential financial mishaps.Learn how to correctly fill out a check in cents with this step-by-step guide. Avoid common mistakes and ensure accuracy.

About The Author

Zeph Grant is a music fanatic. He loves all types of genres and can often be found discussing the latest album releases with friends. Zeph is also a hardcore content creator, always working on new projects in his spare time. He's an amateur food nerd, and loves knowing all sorts of random facts about food. When it comes to coffee, he's something of an expert - he knows all the best places to get a good cup of joe in town.