Last Updated on September 17, 2022

To learn how to make an Iron Butterfly, you can use the CrystalMixer, a website with hundreds of drink recipes. The cocktail contains three main ingredients: vodka, Irish cream, and Kahlua(r) coffee liqueur. You can also try mixing it with other ingredients, such as pineapple juice, gin, or lime juice. To make it easier, use an ice-filled shot glass to strain the drink.

Short spreads

An investor can benefit from trading a range-bound stock using an iron butterfly. The strategy is particularly effective when the price is at its highest near the expiration of an option. The risk associated with this strategy is capped, however, because the time-decay of the options increases the potential profit. However, investors must be aware that it is not for beginners and that it may not be suitable for beginners.

Using an iron butterfly as an example, an investor buys and sells Call and Put options that are close to the cash price. The underlying asset is the same, and the options are of equal strike prices. Typically, the Iron Butterfly expires worthless, but there are times when a stock can reach a price higher than the strike price. If you can make a profit by selling a call and a put at different strike prices, you’re making a short spread.

When making short spreads on an iron butterfly, you should start trading as soon as volatility is expected to fall. This strategy will have a negative Vega and positive Theta, and will work best if you start trading when volatility is predicted to decline. A successful trader will take advantage of this strategy as volatility decreases and he will have an opportunity to profit by shorting the stock. Theta and Vega will make a significant impact on the strategy over time.

Bull put

To profit with an iron butterfly, buy a put below the current market price and a call above it. If the underlying stock moves between the two strikes, the butterfly will be profitable. The maximum profit for this strategy is the net debit you paid for the position. The trader should keep in mind that the price of the underlying stock should not move significantly beyond the iron butterfly’s wings at expiration. However, if the underlying stock does move, you can adjust your time horizon and spreads to take advantage of the price movements.

A partial loss may occur in an Iron Butterfly if the stock is between the short and long strikes. In such a case, the investor would exercise one long leg and assign one short leg to the iron butterfly. In this case, the maximum loss is calculated by adding the debits and credits of both long legs and subtracting the credits from the short legs. However, the investor would still experience a partial loss if the stock is between the short and long strikes.

Bear call

An iron butterfly is made up of two short credit spreads. The butterfly increases in value as the expiration date approaches. As the expiration date approaches, the value of the options becomes higher, and the price of the short option at strike B will become lower. The butterfly’s volatility is affected by the implied volatility, or vega, and will therefore be more profitable as vega decreases. There are many risks associated with an iron butterfly trade.

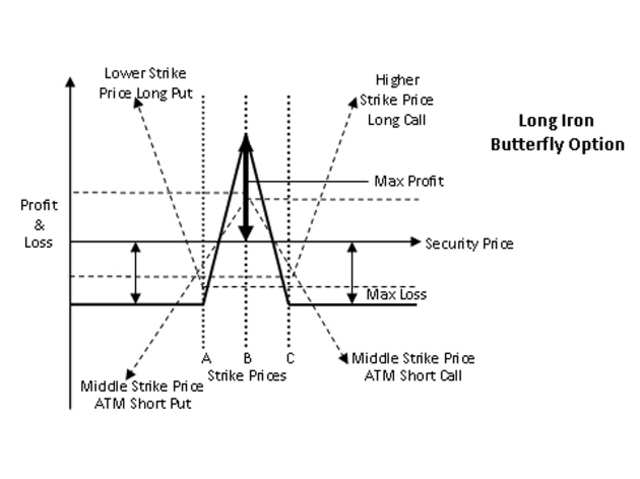

A short iron butterfly is composed of a long call at the upper strike and a short put at the lower strike. The upper and lower strike prices are both equal distances from the middle strike price. The expiration dates of the options are also equal. The strategy is also known as a bear put spread or a bull call spread. Regardless of the trade type, an iron butterfly seeks to be in a narrow range over the life of the options.

Iron butterfly

An Iron Butterfly is a spread combining two short spreads with a directional bias. Ideally, an iron butterfly will expire worthless. It requires a closing fee, but can have a directional bias. For example, if the strike B is higher than strike A, the trade would be a bullish one and vice versa. However, it is important to note that an iron butterfly trade can have a small movement before it loses profitability.

An iron butterfly trade has two breakeven points, or levels at which you can either gain or lose all your investments. You can calculate the breakeven points by using formulae or formulas. For example, assume that the XYZ stock is $40 in June. The options trader will buy a JUL 30 put for $50, write a JUL 40 call for $300, and buy a JUL 50 call for $50. Assuming the stock stays at $40 in July, the trader will receive a net credit of $500 for their positions. The underlying stock will expire at $40 in July, and the trader will keep all of the credit received as profit.

To trade the stock in an Iron Butterfly, you must first determine a target price. This is based on the price history. It is important to remember that the strike prices of the options should be far apart. When the strike prices of the two options differ, the risk of a losing trade is much higher. Nevertheless, an iron butterfly can generate profits even when the stock does not reach its target price. The key is to pick a strike price that is above the price of the put option you are selling.

Break even point

A strategy that limits the possible profit and loss of a trade, the iron butterfly can offer traders a high return in times of low volatility. These options allow traders to keep a portion of the net premium earned when the underlying security closes in between the upper and lower strike prices. An iron butterfly is often used by market players during periods of lower volatility, when they believe the underlying instrument will remain within a specified price range through the expiration date.

The profit window for the iron butterfly position is relatively narrow, compared to many other short volatility strategies. The risk-reward ratio is usually very favorable. The exact numbers for a trade depend on the options strike and expiration dates, but here are some example scenario scenarios to illustrate what the break even point for an iron butterfly position looks like. The break-even point for an iron butterfly trade is $373/127 or $127 for a trade of the same amount.

Time decay

The time-decay feature of Iron Butterfly spreads makes this strategy ideal for trading stocks that are expected to move within a tight price range. As the options expire, the price of the stock is expected to be at a specific level by expiration. The spread can be constructed by selling an ATM call, an OTM call, or a put. Once the option expiration date has been determined, you can sell the OTM call or put.

Iron butterfly options strategy is a multi-leg risk-defined neutral trade that focuses on capturing premiums during the time-decay process. This option strategy involves buying out-of-the-money options on the underlying stock, and selling a call option on the other. This combination creates a risk-defined position that maximizes your profits. Iron butterflies are often initiated when stock prices remain range-bound before expiration, and you can expect to earn income without putting too much money into them.

Using spreads as hedging

Using spreads as hedging to create an iron butterfly involves selling a short straddle and buying a call option at a strike price above the stock’s current price. You will pay a closing fee to close the spread. The value of your spread can vary depending on whether it is directional or neutral. If the strike price of the long call is higher than the strike price of the short put, it is a bullish trade. On the other hand, if the strike price of the call option is lower than that of the stock, it would be a bearish trade.

The heart of the iron butterfly lies in the relationship between the two options. The first option is short, and the second option is long. In both cases, the trader collects a profit. In a short iron butterfly, however, the profit is reduced by the premiums paid. If the underlying price is above the short strike price, the profit will be less than the premium paid. Similarly, if the long option strike price is lower than the short strike price, the loss will be greater. Therefore, the total amount of credit received at the time of entry is referred to as break-even.

Limiting risk

The key to limiting risk when making an iron butterfly is to find a stock that is relatively stable with minimal volatility. An iron butterfly is best made when the underlying stock’s price is at the in-the-money strike price of a short option. This is the most favorable time to buy options, because the underlying stock is likely to experience minimal movement. The price of the underlying stock should also have decreased implied volatility.

If a stock is trading range-bound, you can profit from this setup. The time decay involved in making an Iron Butterfly trade can be high, but the profit potential is very high. In addition, you can use time decay to your advantage, as the highest profit potential comes near expiration of the options. But, you should avoid this setup if you have a longer time horizon. Because of its time decay, an Iron Butterfly may not be suitable for traders with long-term time frames.

A simple example of a basic iron butterfly involves entering a call and put option position in one stock. Using a $50 stock, an investor might buy a put option at $80 and a call option at $110 to profit from the short straddle. A put option expires worthless if the stock does not reach that price, so a long put or long call would be a better strategy.

About The Author

Mindy Vu is a part time shoe model and professional mum. She loves to cook and has been proclaimed the best cook in the world by her friends and family. She adores her pet dog Twinkie, and is happily married to her books.